At ProWell Finvest Services, we began our journey with a clear vision: to revolutionize the financial landscape by empowering individuals, families and businesses to maximize their savings, grow their wealth and secure their financial future.

We are your trusted partners in navigating the complexities of financial planning. With more than 25 years of experience and a deep understanding of the financial markets, we are committed to delivering personalized strategies tailored to your unique goals.

ARN-125694

APRN07083

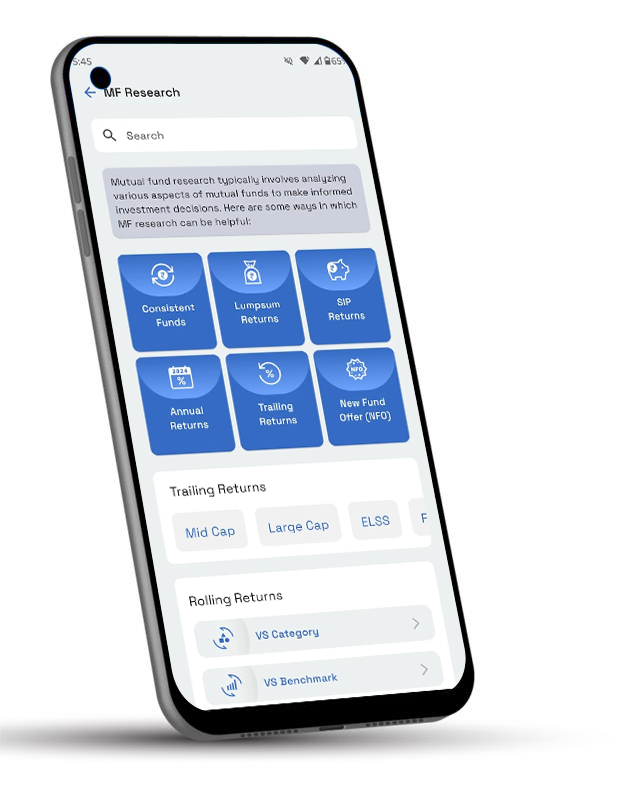

Our mutual fund app makes investing simple, secure, and smart. Browse top-performing funds, track your portfolio in real-time, and invest with just a few taps. Whether you're a beginner or a pro, our app gives you the tools to grow your wealth-anytime, anywhere. Start investing today!

Mutual funds are financial instruments which invest in a portfolio of securities These securities..

Read more

Life insurance is financial product that provides the policy holder financial protection..

Read more

Cost of quality healthcare in India has been sky-rocketing for the past decade or so Hospitalization for..

Read more

Motor insurance is a mandatory requirement if have a car, motorcycle or scooter. You will have ..

Read more

Fixed deposits has traditionally been and still is the most popular investment option in India. As per...

Read more

Gold should be an important part of a diversified investment portfolio because its price increase...

Read more

A wide variety of loan products are available to suit different needs, short term, medium term...

Read more

The plan and action of accumulating a certain corpus by the time you are of retirement age...

Read more

It has been a wonderful experience When I was working as a full time CFO I was too busy and did not find time to analyse investment opportunities and eventually when my savings got accumulated it was deposited into FD or some mutual fund recommended by some friends. The average return was much lower then the normal FD rates

Later I came into contact with Prowell. The first few recommendations from Prowell, I was sure my investments were in safe Hands with a very professional Advisor.

Today When I evaluate my investments through Prowell I am sitting on average returns of more than double the FD returns

Today I just tell PROWELL the money that I want to invest and they come out mutiple options and rank them with their final recommendation. And I just review that and go with their Recommendations. I don’t worry much about my investments nowadays. I know I am in the safe hands of Prowell.

Thank You Prowell and Well done !!

I’ve been taking financial services from Mr. Ranganathan, and I couldn’t be more satisfied with his guidance. He has been extremely professional, patient, and thorough in helping me plan for the future. From life insurance, term insurance, and health insurance to mutual funds, he has provided me with clear explanations, practical options, and the right strategies to secure both my present and future.

What I truly appreciate is that he takes the time to understand my needs and recommends solutions that are both affordable and effective, without any pressure. His knowledge of financial products and his ability to simplify complex topics make decision-making so much easier.

Thanks to his guidance, I feel more confident about my financial planning and well-protected in all aspects. I highly recommend Mr. Ranganathan to anyone looking for a trustworthy and knowledgeable financial advisor.

I am associated with Prowell Finvest Services for last seven years. The advice and foresight provided by Mr Ranganathan were instrumental in helping me manage the investments better and grow the portfolio. Periodic update on the investments made,timely shifting of the funds basis its downtrend are key actionables and support provided. The personalized approach and attention to detail have instilled great deal of confidence in me as an investor. I thank Ranganathan for being part of my investment journey.

When I first started, I had very minimal knowledge about mutual funds and investments, and I was looking for a reliable financial advisor. Mr. Ranganathan has been guiding me with my SIPs and managing my mutual fund investments with great expertise. He is very knowledgeable and takes the time to clearly explain the right financial solutions after understanding my needs. Beyond mutual funds, he also offers a wide range of services, making portfolio management completely stress-free. I would gladly recommend him to anyone looking for trustworthy investment guidance and complete financial planning.

I am Suresh from an engineering background, and Mr. Ranganathan has been a great mentor, guiding me not only professionally but also in planning my expenses, savings, insurance, and investments. With his advice on mutual funds and SIPs, I have seen positive growth in my portfolio and gained confidence in managing both present and future financial goals. I sincerely thank him and highly recommend his services for achieving financial stability and long-term growth.

I am happy to have received and followed ProWell Mr Ranganathan's advice on the financial investment instruments. It was timely, tailored to your needs and the whole process was executed smoothly without hitches. I would recommend Mr Ranganathan for any sort of advice on financial instruments.

My experience with Prowell Finvest Services has been highly positive and impactful in shaping my investment journey. Initially, I began investing in mutual funds through my association with Mr. Ranganathan. Over time, I experienced the professionalism and commitment, consistently provided prompt responses, courteous support, and round-the-clock assistance whenever needed.

Mr. Ranganathan’s ability to explain complex investment concepts with clarity made it much easier for me to understand and make informed decisions. Additionally, Prowell’s user-friendly interface has been a significant asset in efficiently tracking and managing my portfolio.

I am sincerely grateful to Mr. Ranganathan and the Prowell Finvest team for their guidance and support. My journey with them has been excellent so far, and I look forward to a long-term association in the years ahead

Midcap funds have always been popular with retail investors. Its popularity has only grown further in recent years with ...

Read More

Every November, as we celebrate Children's Day, we honour the innocence, joy, and limitless potential of childhood. Pare...

Read More

SIP involves investing a fixed amount periodically, making it an accessible and disciplined way to build long term wealt...

Read MoreThe investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty Ne...

Read More...The investment objective of the Scheme is to generate returns that are commensurate with the performance of the Nifty 50...

Read More...Passive Investment in equity and equity related securities replicating the composition of Nifty Next 50 Index, subject t...

Read More...The investment objective of the scheme is to generate returns corresponding to the Domestic Price of Gold before expense...

Read More...The investment objective of the scheme is to generate returns by investing in units of Gold ETFs and Silver ETFs. Howeve...

Read More...